Keep CA’s Cannabis Industry Alive By Halting a Tax Increase

April 28, 2025

Failed Businesses Don’t Pay Taxes

WRITE TO YOUR LEGISLATOR AND ASK THEM TO SUPPORT AB 564

AB 564 (Haney), a bill that would freeze California’s state excise tax on cannabis at 15%, rather than seeing it raise to 19% on July 1, 2025, will next be heard on Monday, May 5 at 2:30 PM in the Assembly Revenue and Taxation committee. Come and show your support!

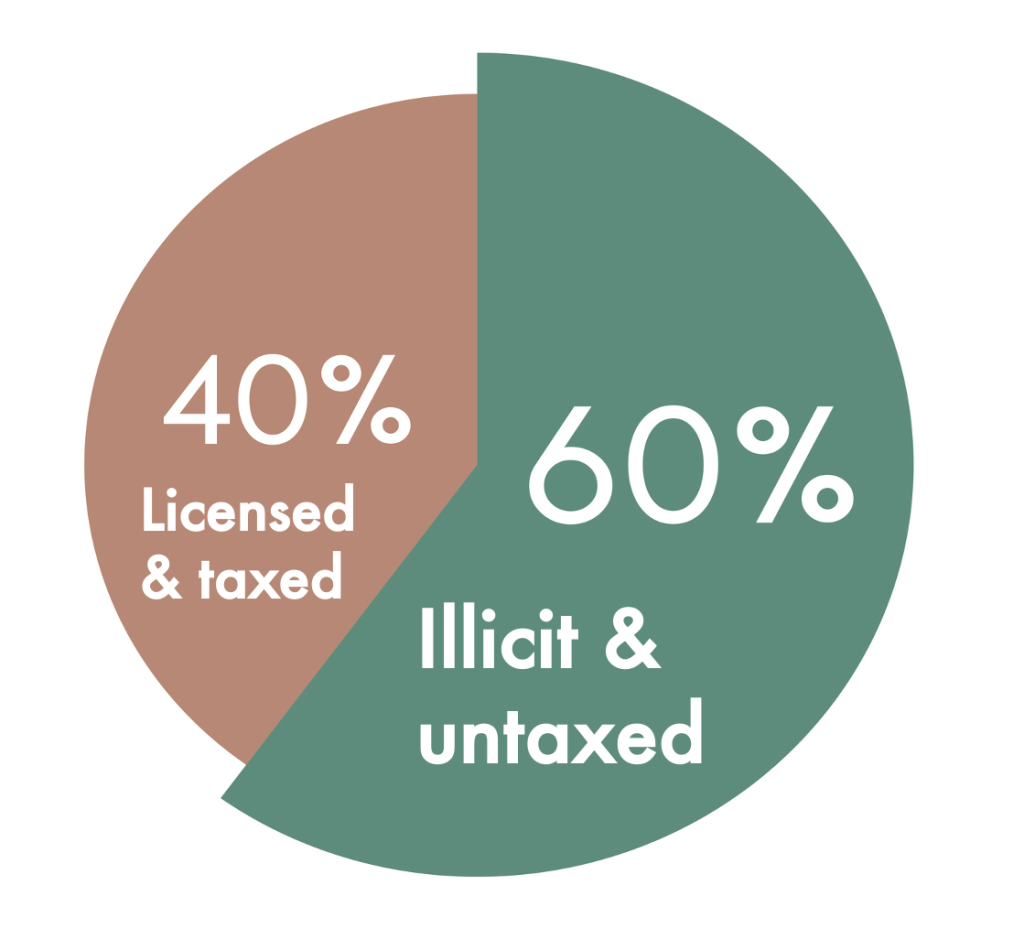

California’s cannabis market has lost 30% of its active licenses in the past two years

Inactive cannabis licenses are climbing as California companies struggle to stay in business. Inactive licensees don’t make money, or pay taxes. Many of the inactive licenses are equity businesses, who are already facing a de facto tax increase as the cannabis equity tax credit is set to expire on 12/31/27.

California’s licensed retail footprint has flatlined at roughly 1,225 active stores since mid-2023, as 57% of the state’s cities and counties still prohibit cannabis dispensaries, according to the California Department of Cannabis Control (DCC).

Read More